Annual Gifting Amount 2024

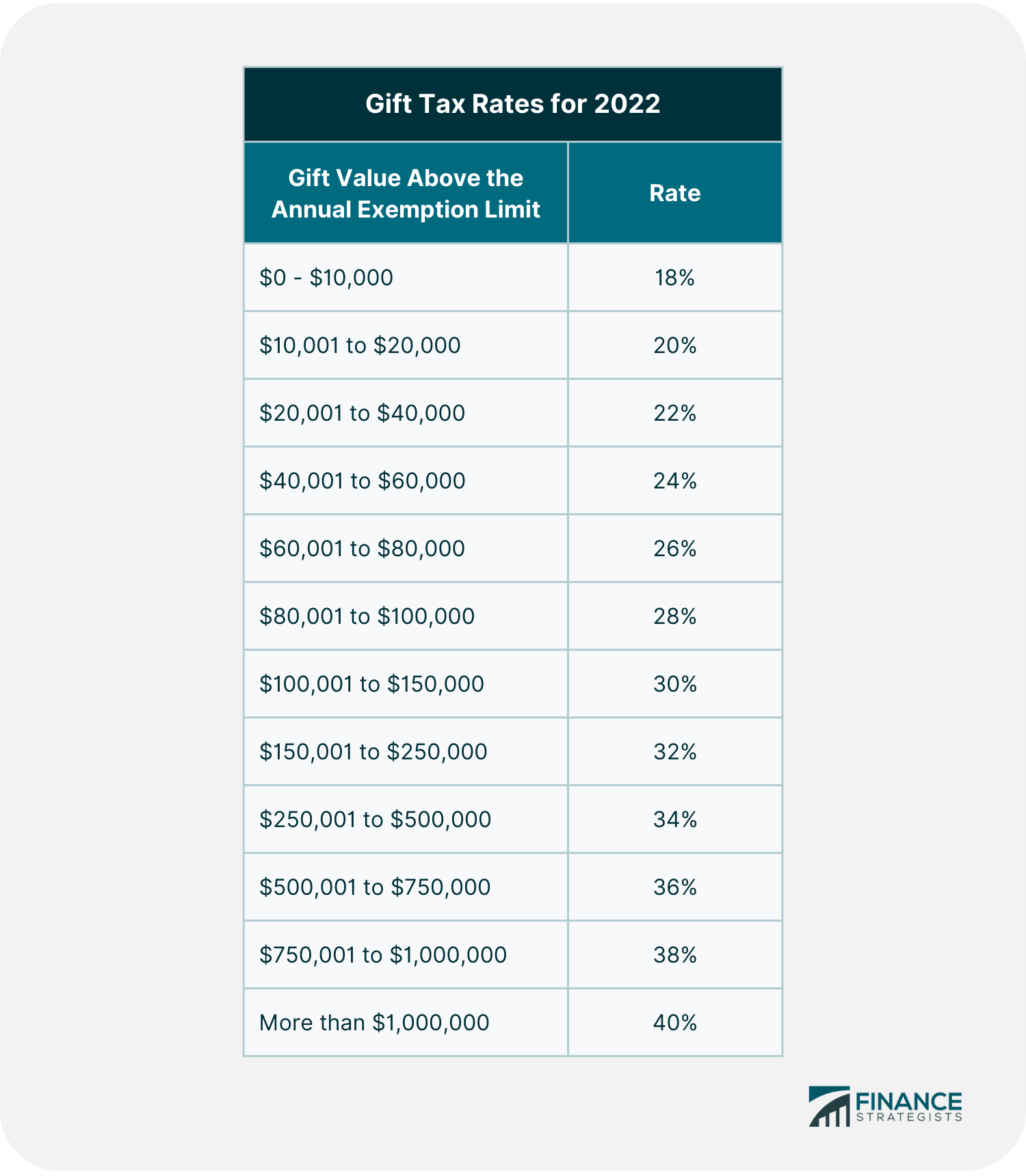

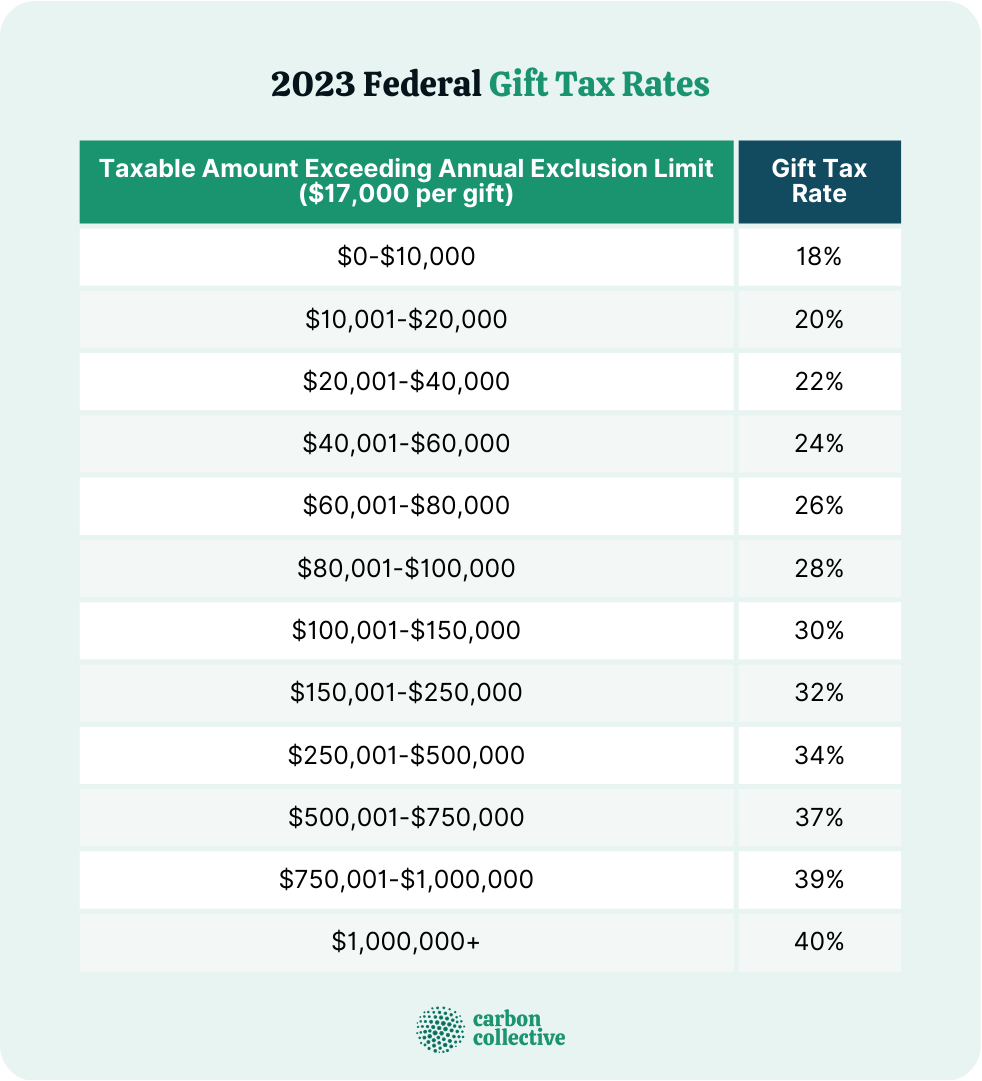

Annual Gifting Amount 2024. The annual gift tax exclusion in 2022 is $16,000. Starting from calendar year 2024, the annual exclusion for gifts will increase to $18,000, up from $17,000 in 2023.

As of january 2022, the annual gift tax exclusion was set at $15,000 per recipient. 1 for 2024, the limit has been adjusted for inflation and will rise to $18,000.

Annual Gifting Amount 2024 Images References :

Source: kattibleonanie.pages.dev

Source: kattibleonanie.pages.dev

Annual Gift Tax Exclusion 2024 Amount Chart Danya Ellette, The federal gift, estate and gst tax exemption.

Source: kimberlynwalvera.pages.dev

Source: kimberlynwalvera.pages.dev

What Is The Limit On Gift Tax For 2024 Rory Walliw, The gift tax limit (or annual gift tax exclusion) for 2023 is $17,000 per recipient.

Source: imagetou.com

Source: imagetou.com

Annual Gifting For 2024 Image to u, By gb times / june 22, 2024.

Source: kallyconstanta.pages.dev

Source: kallyconstanta.pages.dev

Annual Gift Tax Exclusion 2024 Per Person Lexie Opalina, By gifting within the annual exclusion amount, to children, or jointly with another person, you can minimize your gift tax liability.

Source: charleanwgerry.pages.dev

Source: charleanwgerry.pages.dev

Annual Gift Tax Exclusion 2024 Golda Gloriane, The gift tax limit (or annual gift tax exclusion) for 2023 is $17,000 per recipient.

Source: jacquelinwesme.pages.dev

Source: jacquelinwesme.pages.dev

Gift Exclusion Amount 2024 Gwen Pietra, In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2024, estimated to be $19,000 in 2025).

Source: marneqmiguelita.pages.dev

Source: marneqmiguelita.pages.dev

2024 Lifetime Gift Exclusion Otha Tressa, (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.) for married couples,.

Source: ilyssaqcissiee.pages.dev

Source: ilyssaqcissiee.pages.dev

Annual Federal Gift Tax Exclusion 2024 Niki Teddie, They write her a check for $30,000, which jennifer cashes before the end of the year.

Source: eadaqursulina.pages.dev

Source: eadaqursulina.pages.dev

Annual Gift Tax 2024 Deeyn Evelina, The annual gift tax exclusion in 2022 is $16,000.

Source: www.haasfinancialgroup.com

Source: www.haasfinancialgroup.com

2024 Gifting Updates Haas Financial Group, For 2024, the annual gift tax limit is $18,000.

Posted in 2024